Auckland ranked fourth most unaffordable city in the world

Every now and then, you come across a social media post on how Auckland has been named world’s best or one of the world’s best city—for its lifestyle, for its beauty, for travelling, and most recently as world’s least corrupt country. The City of Sails has once again found a spot in another world’s top list but this time not for a good reason.

Auckland has been ranked fourth most expensive city in the world to buy a house. With a median multiple of 10.0, a homebuyer would need to have an average income that is 10 times the current one. Median multiple is an index that allows a quick comparison of different housing by linking median or average house prices to median household income.

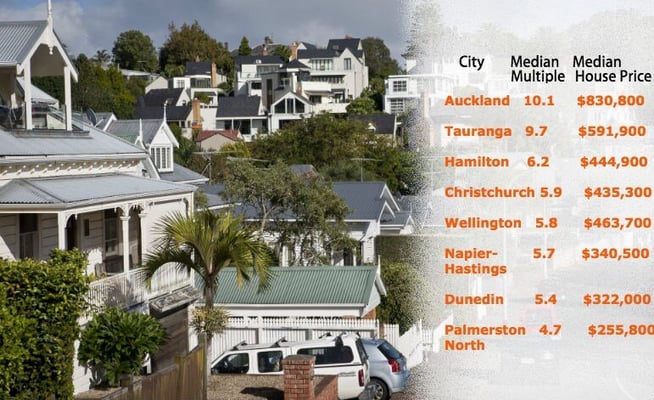

As per the recently published 13th Annual Demographia International Housing Affordability Survey, the median house price in Auckland has climbed to $830,800 while the median household income is $83,000—ten times less than the average house price.

Auckland has jumped a spot from last year and is currently behind Hong Kong, Sydney, and Vancouver out of the 92 major cities and 406 housing markets in nine countries.

Hong Kong has been ranked the most unaffordable city with a median multiple of 18.1, followed by Sydney (12.2) and Vancouver (11.8).

According to the survey, a ratio of three or less is considered affordable.

The results of the survey are not surprising for the Auckland homebuyers, as the ‘housing crisis’ here doesn’t seem to end anytime soon.

Not only Auckland but also other New Zealand cities are increasingly becoming unaffordable. House prices in Tauranga have gone up by 20% from last year, reaching 9.7 times the average income.

Overall, New Zealand has been rated severely unaffordable with a median multiple of 5.9, making it extremely difficult for people to buy their first house. According to QV House Price Index, in 2015 alone, the house prices have soared up by 24% while there hasn’t been enough raise in wages.

Auckland Mayor Phil Goff told NZ Herald that there is a need to increase the house supply.

"The reason is obvious. Our population in the city has gone up by 45,000 a year. We need about 15,000 extra houses a year and are only building about half that number,” he said. “Supply is falling far short of demand and that puts prices up. In that environment, we are also getting speculative pressures with houses being flipped and going up by hundreds of thousands of dollars in a day as speculators clip the ticket.”

Mr Goff added that after the appeal process of the Unitary Plan is completed, it will enable the construction of 422,000 housing units on brownfields developments and 150,000 units on greenfields sites, which will help eliminate the major cost factor in Auckland housing viz. supply of land.

“I also want to work closely with [the] government to deal with the deficit in infrastructure funding so we can put the services and transport links in place to enable houses to be built,” he said.

Building and Construction Minister Nick Smith told NZ Herald that the government is making “good progress in addressing excessive house inflation in Auckland, with the latest annual increase in single digit for the first time in last five years.” He added that government has increased the housing investment by 32% in the latest year and is now topping more than 10,000 Auckland houses per year.

Major factors that contribute to the Auckland housing crisis

Undersupply of houses: This is the major contributing factor in increasing house rates in Auckland. Until November last year, Auckland had about 4,800 less home to supply compared to the demand. Hence, there is an increasing pressure on the housing market that has resulted in the increase of property rates.

Low-interest rates: In a recent report published in NZ Herald, Gareth Kiernan, the chief forecaster for Infometrics, said that the low mortgage rates on offer have limited the extent of increases in debt-servicing costs. However, the interest rate is expected to increase to 1.5–2%, which could make the repayments challenging for many mortgage-holders in Auckland.

Every now and then, you come across a social media post on how Auckland has been named world’s best or one of the world’s best city—for its lifestyle, for its beauty, for travelling, and most recently as world’s least corrupt country. The City of Sails has once again found a spot in another world’s...

Every now and then, you come across a social media post on how Auckland has been named world’s best or one of the world’s best city—for its lifestyle, for its beauty, for travelling, and most recently as world’s least corrupt country. The City of Sails has once again found a spot in another world’s top list but this time not for a good reason.

Auckland has been ranked fourth most expensive city in the world to buy a house. With a median multiple of 10.0, a homebuyer would need to have an average income that is 10 times the current one. Median multiple is an index that allows a quick comparison of different housing by linking median or average house prices to median household income.

As per the recently published 13th Annual Demographia International Housing Affordability Survey, the median house price in Auckland has climbed to $830,800 while the median household income is $83,000—ten times less than the average house price.

Auckland has jumped a spot from last year and is currently behind Hong Kong, Sydney, and Vancouver out of the 92 major cities and 406 housing markets in nine countries.

Hong Kong has been ranked the most unaffordable city with a median multiple of 18.1, followed by Sydney (12.2) and Vancouver (11.8).

According to the survey, a ratio of three or less is considered affordable.

The results of the survey are not surprising for the Auckland homebuyers, as the ‘housing crisis’ here doesn’t seem to end anytime soon.

Not only Auckland but also other New Zealand cities are increasingly becoming unaffordable. House prices in Tauranga have gone up by 20% from last year, reaching 9.7 times the average income.

Overall, New Zealand has been rated severely unaffordable with a median multiple of 5.9, making it extremely difficult for people to buy their first house. According to QV House Price Index, in 2015 alone, the house prices have soared up by 24% while there hasn’t been enough raise in wages.

Auckland Mayor Phil Goff told NZ Herald that there is a need to increase the house supply.

"The reason is obvious. Our population in the city has gone up by 45,000 a year. We need about 15,000 extra houses a year and are only building about half that number,” he said. “Supply is falling far short of demand and that puts prices up. In that environment, we are also getting speculative pressures with houses being flipped and going up by hundreds of thousands of dollars in a day as speculators clip the ticket.”

Mr Goff added that after the appeal process of the Unitary Plan is completed, it will enable the construction of 422,000 housing units on brownfields developments and 150,000 units on greenfields sites, which will help eliminate the major cost factor in Auckland housing viz. supply of land.

“I also want to work closely with [the] government to deal with the deficit in infrastructure funding so we can put the services and transport links in place to enable houses to be built,” he said.

Building and Construction Minister Nick Smith told NZ Herald that the government is making “good progress in addressing excessive house inflation in Auckland, with the latest annual increase in single digit for the first time in last five years.” He added that government has increased the housing investment by 32% in the latest year and is now topping more than 10,000 Auckland houses per year.

Major factors that contribute to the Auckland housing crisis

Undersupply of houses: This is the major contributing factor in increasing house rates in Auckland. Until November last year, Auckland had about 4,800 less home to supply compared to the demand. Hence, there is an increasing pressure on the housing market that has resulted in the increase of property rates.

Low-interest rates: In a recent report published in NZ Herald, Gareth Kiernan, the chief forecaster for Infometrics, said that the low mortgage rates on offer have limited the extent of increases in debt-servicing costs. However, the interest rate is expected to increase to 1.5–2%, which could make the repayments challenging for many mortgage-holders in Auckland.

Leave a Comment